ESG

Iguana Investments aims to be a responsible participant in global capital markets and recognises its responsibilities regarding the importance of Environmental, Social, and Corporate Governance (ESG). Further details may be obtained via the following links:

Sustainable Finance Disclosure Regulation (Regulation (EU) 2019/2088) (“SFDR”)

The purpose of this Section is to provide investors with certain disclosures required under the SFDR. Further information can be found at https://www.waystone.com/sfdr/ and www.iguanainvestments.com/ESG

Following the UK’s departure from the European Union and the end of the transition period on 31 December 2020 the SFDR is not part of UK law. This means that, as a UK-based investment manager, Iguana Investments Limited (the “Investment Manager”) is outside the scope of SFDR. However, the Investment Manager has decided to adopt the SFDR on a voluntary basis with respect to the Iguana Investments ICAV it manages.

SECTION 1: The Iguana Investments Long/Short Equity Fund (“Fund”) Specific Disclosures

a) Summary

The Investment Manager (referred to as “IM” hereafter) aim to be a responsible participant in global capital makets and recognises the associated responsibilities regarding the importance of Environmental, Social and Governance (ESG) issues. This means that, whilst in general the IM is focused on delivering financial returns to the underlying investor base (the fund’s objective being to generate an overall investment return through long-term capital growth as well as dividend and other income), the IM also believes that understanding and influencing the ESG stance of the companies in which the IM invests is critical not just to the investment performance of that company but also because corporate sustainability policies have a critical impact on wider society. Therefore, the IM recognises that by identifying, quantifying and seeking to act upon ESG issues within the investment portfolio, not only could investment performance be improved, but the IM can also be better aligned with its investors and the broader objectives of society.As an Article 8 Fund, the Fund does not have sustainable investment as its primarily objective; it aims to have a minimum proportion of 60% of investments that are aligned with its chosen Environmental/Social (“E/S”) characteristics. Further, the Fund does not invest in sustainable investments with an environmental objective, which are aligned with EU Taxonomy under the Taxonomy Regulation. As a result, the percentage of the Fund's investments that will be in economic activities that qualify as environmentally sustainable is 0%.The Fund intends to promote environmental and social characteristics in accordance with Article 8 of SFDR through its investment selection process.The characteristics promoted by this financial product consists of applying to the portfolio construction process, upfront exclusion filters that focus on the environment and which restrict investment in companies and issuers that fail to pass these following criteria:

1. whose CO2 emissions are increasing, as measured on a year-to-year basis; and2. who are not on a clear trajectory to improving CO2 emissions; and3. who have not committed to reducing CO2 emissions by the Paris-aligned target of 45% by 2030 and net zero by 2050.

Each investment must meet all three critera in order to be excluded from the investment universe. The criteria are measured by the Investment Manager using third-party databases and internal research which are based on a mix of quantitative and qualitative data.Further, the Investment Manager seeks to avoid companies with known practices that are significantly harmful to society, broadly following the principles of the UN Global Compact (“UNGC”), such as corruption, lack of transparency, ethical violations, or other potential human rights violations. While many factors may be considered in the assessment of any investment, the Fund will also seek to avoid investing in companies which themselves or through entities or issues such companies control, produce or are involved in controversial weapons (anti-personnel mines, cluster munitions, chemical weapons and biological weapons).The Investment manager monitors the portfolio for the E/S characteristics on an on-going basis (quarterly as a minimum) to understand the overall footprint of the investments and assess if action is required. Any investments considered to be in breach of these characteristics on the long side are reviewed with a view to understand reasons for negative externatilities and removed from the portfolio if no improvement can be established.Limitations to the Investment Manager’s ability and ESG process are outlined in further detail below. However, the primary limitation is around data availability as the Fund uses data that is sourced directly from companies via Bloomberg or internal research from company filings. In the absence of necessary ESG disclosures by companies, the Investment Manager aims to contact the company to obtain such information and where unavailable, the Investment Manager will likely not proceed with that investment.The Investment Manager has also committed to give 10% of any net profits generated by the company to charitable causes related to Wildlife Conservation & Research as a first step to ensuring that its corporate values align with the sustainability objectives of wider society. The Investment Manager believes this approach ensures that, as a company, it can help to create a degree of societal benefit while participating in the global capital markets, a goal that aligns with the interests of its employees, clients, and the wider global community, whilst at the same time ensuring that the commitment does not impose a cost penalty to clients investing in the IM’s funds.

b) No sustainable investment objective

The Fund promotes E/S characteristics but does not have as its objective sustainable investment.The Fund does not invest in sustainable investments with an environmental objective, which are aligned with EU Taxonomy under the Taxonomy Regulation. As a result, the percentage of the Fund's investments that will be in economic activities that qualify as environmentally sustainable is 0%. While it does not have sustainable investment as its objective, it will have a minimum proportion of 60% of investments that are aligned with its chosen E/S characteristics.The Fund intends to promote environmental and social characteristics in accordance with Article 8 of SFDR through its investment selection process. The Investment Manager defines environmental and social characteristics as those environmental, social or governance criteria that have a positive environmental and/or social impact.The characteristics promoted by this financial product consists of applying to the portfolio construction process, upfront exclusion filters that focus on the environment and which restrict investment in companies and issuers that fail to pass these following criteria:

1. whose CO2 emissions are increasing, as measured on a year-to-year basis; and2. who are not on a clear trajectory to improving CO2 emissions; and3. who have not committed to reducing CO2 emissions by the Paris-aligned target of 45% by 2030 and net zero by 2050.

Each investment must meet all three critera in order to be excluded from the investment universe. The criteria are measured by the Investment Manager using third-party databases and internal research which are based on a mix of quantitative and qualitative data.Further, the Investment Manager seeks to avoid companies with known practices that are significantly harmful to society, broadly following the principles of the UNGC, such as corruption, lack of transparency, ethical violations, or other potential human rights violations. While many factors may be considered in the assessment of any investment, the Fund will also seek to avoid investing in companies which themselves or through entities or issues such companies control, produce or are involved in controversial weapons (anti-personnel mines, cluster munitions, chemical weapons and biological weapons).The Investment manager monitors the portfolio for the E/S characteristics on an on-going basis (quarterly as a minimum) to understand the overall footprint of the investments and assess if action is required. Any investments considered to be in breach of these characteristics on the long side are reviewed with a view to understand reasons for negative externatilities and removed from the portfolio if no improvement can be established.The Principal Adverse Impact (“PAI”) indicators as set out in Annex I of SFDR have not been considered as part of the assessment of whether a relevant investment meets the Principle of No Significant Harm (“DNSH”) threshold.

c) Environmental or social characteristics of the financial product

Noting that the Fund does not invest in sustainable investments with an environmental objective (which are aligned with EU Taxonomy under the Taxonomy Regulation), and therefore that the percentage of the Fund’s investments that will be in economic activities that qualify as environmentally sustainable is 0%, the Fund aims to promote E/S characteristics in accordance with Article 8 of SFDR through its investment selection process.The Investment Manager defines environmental and social characteristics as those environmental, social and governance criteria that have a positive environmental and/or social impact. To respect the requirements of Article 8 of Regulation (EU) 2019/2088 (the “Sustainable Finance Disclosure Regulation” or the “SFDR”), the characteristics promoted by this financial product consists of applying to the portfolio construction process, upfront exclusion filters that focus on the environment and which restrict investment in companies and issuers that fail to pass these following criteria:

1. whose CO2 emissions are increasing, as measured on a year-to-year basis; and2. who are not on a clear trajectory to improving CO2 emissions; and3. who have not committed to reducing CO2 emissions by the Paris-aligned target of 45% by 2030 and net zero by 2050.

Each investment must meet all three critera in order to be excluded from the investment universe. The criteria are measured by the Investment Manager using third-party databases and internal research which are based on a mix of quantitative and qualitative data.To measure the attainment of the environmental characteristics, the Investment Manager uses environmental indicators and data available from third-party providers such as Bloomberg supplemented by the Investment Manager’s own internal research.Once the process of ensuring that that prospective investments with the above characteristics are excluded from consideration, the Investment Manager then moves to considering more qualitative social, governance and related environmental characteristics in more detail when analysing individual investments, as outlined in the Investment Strategy section below.These measures and indicators are used and fully integrated into the research process and comprise part of the continous reviews in the investment process, sitting alongside the Investment Manager’s other investment decision-making criteria.

d) Investment strategy

The Fund will hold a high conviction equity portfolio of long and (synthetic) short positions selected by means of detailed traditional fundamental, macroeconomic and contemporary quantitative analysis. The Fund will invest in a diversified portfolio of equity securities, equity related securities, Financial Derivative Instruments (“FDI”), and collective investment schemes. The Fund will be diversified by region, country, sector and company holdings.The Investment Manager will generally utilise a long/short strategy. A long/short strategy means the Investment Manager may take a long position, either directly or indirectly through the use of a FDI, in an equity or equity-related security the Investment Manager believes is undervalued and a short position, via a FDI (and not by physically short selling securities), in other equity or equity-related securities the Investment Manager believes are overvalued. The underlying equity or equity-related securities to which the Fund will have exposure as a result of investing in derivatives will be consistent with the investment policy of the Fund.This screening process narrows the universe to a sub-set of potential investments. The Investment Manager is required to consider good governance standards of companies in the selection of securities for investment.The Investment Manager’s portfolio construction process excludes investments in companies and issuers who meet the following criteria:

1. whose CO2 emissions are increasing, as measured on a year-to-year basis; and2. who are not on a clear trajectory to improving CO2 emissions; and3. who have not committed to reducing CO2 emissions by the Paris-aligned target of 45% by 2030 and net zero by 2050.

Further, the Investment Manager seeks to avoid companies with known practices that are significantly harmful to society, broadly following the principles of the UNGC, such as corruption, lack of transparency, ethical violations, or other potential human rights violations. While many factors may be considered in the assessment of any investment, the Fund will also seek to avoid investing in companies which themselves or through entities or issues such companies control, produce or are involved in controversial weapons (anti-personnel mines, cluster munitions, chemical weapons and biological weapons).The Investment Manager uses data primarily provided by Bloomberg, supplemented by its own internal research, in order to generate the issuer names captured by these binding exclusionary screens. The list of excluded names is reviewed and updated regularly and has been built into the Investment Manager’s initial review process and within the securities list that is maintained in the Order and Portfolio Management System. Should a new name be added to the screen, which is already held in the portfolio, it must be exited within a reasonable time and in an orderly manner by the Investment Manager.When analysing 'good governance' practices across the universe of potential investments, the Investment Manager considers several indicators in accordance with the Investment Manager’s ESG assessment methodology, as described under the heading "Investment Policies", sub-heading "SFDR" in the Addendum to the Supplement. The Investment Manager evaluates corporate governance factors such as overall Board gender and diversity composition, CEO duality and gender pay gap where possible and a company's stated ESG ambitions overall and look for indications that the company is working towards being sustainable and has identified clear areas of improvement or set specific sustainability targets that align with its financial goals/strategy. The Investment Manager also recognises the potential financial and reputational risks that could arise from issues such as management reputation, financial controls, fraud and potential conflicts of interest. Although many factors go into a specific investment decision, the Investment Manager believes that company analysis must also look at what a company is saying regarding sustainability in their earnings calls and investor communications, similar to the analysis undertaken of financial disclosures and commentary.When establishing detailed research applicable to an individual company, as recommended by the UN Principles of Responsible Investment (“UNPRI”), the Investment Manager considers the impact of governance factors across the financial forecasting process, in particular revenue, operating costs, book value of assets and capital expenditure. For example, the Investment Manager will, if and where appropriate, load the discount rate for a particular stock to a higher value if the business is considered to have a significantly negative governance impact.As regards engagement, in addition, all company meetings are documented and during these meetings the Investment Manager seeks to challenge management in a positive manner on the importance of improving their company operations and any related governance issues.

e) Proportion of investments

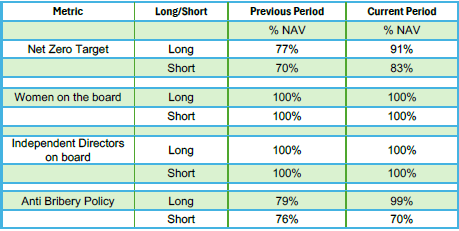

Please find below a Table explaining the asset allocation to the Fund:#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments. The Fund uses derivatives solely for the purposes efficient portfolio management and not to promote environmental or social characteristics.

- 60% aligned with E/S characteristics: Fund aims to invest at least 60% of its assets in companies promoting environmental or social characteristics as per above.- Other: Investments in “#2 Other” include investments that may not promote an environmental or social goal but these investments must still, at a minimum, meet the Fund’s good governance criteria and exclusionary policies. Investments that might fall under "#2 Other" include equity securities or collective investment schemes (not aligned with E/S characteristics), cash positions, cash equivalents and financial derivative instruments. The Investment Manager may invest in "#2 Other" investments where the Investment Manager believes such investments are consistent with the Fund's investment objective and in accordance with the Fund's investment policy, further details can be found within the Supplement under Section 2, sub-header "Investment Policies".Given the nature of such investments, there is no minimum environmental or social safeguards. Although the basic precondition used in the selection of the Fund’s assets is the alignment to the E/S characteristics, there may be occasions when this is not the case.The investments underlying this Financial Product do not consider the EU criteria for environmentally sustainable economic activities aligned with EU Taxonomy. The minimum proportion of the Fund’s investments that contribute to environmentally sustainable economic activities for the purposes of the EU Taxonomy will be 0%.

f) Monitoring of environmental or social characteristics

The E/S characteristics of the Fund are monitored using data provided by Bloomberg, supplemented by its own internal research, in order to generate the issuer names captured by the binding exclusionary screens noted in paragraph (c) above. The list of excluded names is reviewed and updated regularly and has been built into the Investment Manager’s initial review process and within the sucurities list that is maintained in the Order and Portfolio Management System. Should a new name be added to the screen, which is already held in the portfolio, it must be exited within a reasonable time and in an orderly manner by the Investment Manager.Monitoring of investment compliance using the above criteria is formally reviewed regularly by the Investment Manager, at least quarterly. Further, a more regular risk review meeting is conducted across the portfolio by the Investment Manager, this is typically weekly but at a minimum monthly. In this meeting individual investments are discussed and, should any new information come to pass regarding the Environmental, Social or Governance criteria discussed above, or any other information considered relevant to the investment case of the security, the above process is also triggered, meaning that from then a new name added to the screen must be exited within a reasonable time and in an orderly manner by the Investment Manager.

g) Methodologies

With respect to the promotion of E/S characteristics, the Fund measures the attainment of such characteristics by ensuring that a minimum of 60% of investments are only made in those entities that do not fail the three binding criteria outlined in paragraph (c) above. The Investment Manager has developed and maintains an ESG databse in-house for the entities in the Investment Manager’s coverage universe, primarily using data from Bloomberg (and where unavailable from individual company filings).As a first step, before proceeding with the financial analysis of an idea, the stock is first screened to ensure that it does not fail the three exclusion criteria identified above using a tool developed internally by the Investment Manager. This exclusion list is maintained on an on-going basis internally with more details available on request. If the stock fails to pass (i.e it ticks all three criteria in that: 1) it is seeing rising Scope 1 & 2 emissions; 2) it has no clear trajectory to improve its emissions; and 3) it has no net zero target in line with the Paris climate agreement), the investigation ends there and a note is made as it why it failed the test. If the stock passes this initial test, then following this an assessment is conducted to establish that the business is not involved in the controversial weapons noted above (for a diverse business with many end markets this may require significant fundamental investigation and so the issue may also be discussed at the end of any analysis conducted on the stock once full information has been established).Following these investigations, the IM then proceeds with the fundamental analysis of the stock, noting that as part of this analysis the following ESG factors are considered specifically:

- corporate governance factors such as overall Board gender and diversity composition, CEO duality and gender pay gap where possible- the company’s stated ESG ambitions overall, seeking indications that the company is working towards being sustainable and has identified clear areas of improvement or set specific sustainability targets that align with its financial goals/strategy.

h) Data sources and processing

The Fund uses data primarily available in Bloomberg, which is sourced directly from company filings and internal research where this is not available. With reference to the binding commitments highlighted in paragraph (c) “Environmental or social characteristics of the financial product” and the other corporate governance factors monitored by the fund, the Investment manager collects data using:

• Scope 1, 2 and 3 emissions reported by Bloomberg, and where not available in Bloomberg then from individual company filings• Commitment to Net Zero, reported by Bloomberg, and where not available in Bloomberg then from individual company filings• Trajectory for decreasing carbon emissions and future plans from individual company filings• UNGC signatory data from Bloomberg• Compliance with each of the ten principles set out by the UNGC from Bloomberg• Participation in the sale and manufacture of controversial weapons from Bloomberg• Controversy score from MSCI Categories• Percentage of female representation on the Board from Bloomberg

If the necessary data for the binding criteria is not immediately available, then the Investment Manager does not make estimates for this data, but would aim to request such data directly from the company.

i) Limitations to methodologies and data

As outlined above, the Fund aims to primarily use data that is directly sourced from companies collated by Bloomberg and internal research where this is not available. Analysis is conducted in-house because the IM believes that transparancy in the original source of the data is important given the fundamental, bottom-up, investment process, such that ESG analysis should be carried out similar to fundamental analysis of a stock to ensure overall ESG ambitions tie into financial ambitions and vice-versa. Given this methodology, the following limitations to methods and data have been identified:

- Given the early stages of ESG reporting and data disclosure, the availability of the data sought might be limited, particularly among those entities with smaller market capitalisations or non-institutional shareholders.- The Fund relies on the data disclosed by the companies themselves and are not equipped to test the validity of this data. As a result any errors in their reporting methodology might adversely affect the ESG analysis done up to that point.- Entities might aim to suppress any ESG controversies or violations of UNGC Principles.

While the IM believes that some of these potential limitations should improve over time as ESG is fully adopted by the investment community, the Investment Manager aims to mitigate the above identified limitations as follows:

- In the event that data is unavailable, the Investment Manager does not intend to make estimates at present but will contact the company for further information where possible. If the company is not forthcoming with in its disclosure, then it is likely that the investment will not be made or will be divested within a reasonable timeframe- Most companies in the Investment Managers coverage widely use recognised providers for calculating and audited ESG disclosures. For example, emissions data and net zero goals are largely set in-line with the SBTi (which issues guidance and promotes target setting using scientific methodoogies). As a result it appears unlikely that a company intentionally miscalculates the reported data. However, if this does happen, the Investment Manager will review the updated disclosure in line with the criteria outlined above and if the entity is found to no longer meet the binding criteria noted in paragraph (c) above, it will be divested within a reasonable timeframe.- Any controversies that come to light will be assessed immediately, with a view to exiting the investment within a reasonable timeframe

j) Due diligence

- The Fund maintains compliance with the three binding criteria identified in paragraph (c) above for a list of companies that are in the core coverage universe on an ongoing basis.- The excluded companies (or companies that are screened out) are flagged in the internally developed tool and will be flagged if the company is re-visited in the future.- As part of the fundamental analysis of a company, the Investment Manager undertakes detailed financial modelling of the company to examine its revenue, profitability, cash generation and balance sheet position. Similar to this analysis, the models also include an ESG overview of the entity where a broader set of Environmental, Social and Governance data is populated for each entity and a comment made for the characteristics monitored by the Fund.- The Fund records absolute emissions data, compliance with UNGC Principles, Controversial Weapons involvement, Board Diversity for all companies in the portfolio. This data is monitored on a regular basis as outlined in the sections above.

k) Engagement policies

The Investment Manager meets the management of its investee companies regularly as part of its investment process. These meetings are seen as a key element in discharging the IM’s stewardship responsibilities. At these meetings the IM seeks to challenge management on their delivery of corporate strategy, financial and non-financial performance or risk, allocation of capital and management of environmental, social and governance issues.In addition to directors and business managers, Iguana Investments engages with other executives as available. Iguana Investments also engages with board directors, either as part of a regular dialogue or to raise and escalate issues of concern.

l) Designated reference benchmark for product that promote environmental or social characteristics website section

The investment performance of the Fund will be measured against the MSCI World Index, measured in GBP (the “Index”). The index has not been designated as a reference benchmark to meet the environmental or social characteristics promoted by the Fund.

SECTION 2: Entity Level Disclosure

The following Funds have been classified as Article 8 products for the purposes of SFDR: Iguana Investments Long/Short Equity Fund

Sustainability Risk Policy Statement

The Investment Manager integrates the consideration of Sustainability Risks into the due diligence it undertakes as part of its investment decision processes. However, the Investment Manager does not screen out potential investments based solely on Sustainability Risks. Further, the Investment Manager does not invest in or divest specific assets based solely on Sustainability Risks, as the Investment Manager’s key objective in managing the Fund is to generate an overall investment return through long-term capital growth as well as dividend and other income. The likely impact of Sustainability Risks on the returns of the Fund has been assessed by the Investment Manager and it has been determined to be low. However, Sustainability Risk is an evolving, multi-faceted and multi-point-impact risk category and there can therefore be no guarantee that this will remain the case throughout the lifetime of the Fund.

No Consideration of Sustainability Adverse Impacts

The Investment Manager has elected for the time being not to consider the principal adverse impacts of investment decisions of the Fund on Sustainability Factors, primarily as the regulatory technical standards supplementing SFDR which will set out the content, methodology and information required in the principal adverse sustainability impact statement remain in draft form and have been delayed. The Investment Manager will keep the decision to not consider the principle adverse impacts on Sustainability Factors under review and will formally re-evaluate this decision on a periodic basis.

Remuneration Policy

The Investment Manager has updated its remuneration policy to meet the requirements of SFDR. The remuneration policy is designed to ensure that the remuneration of key decision makers is aligned with the management of short and long-term risks, including the oversight and where appropriate the management of sustainability risks in line with SFDR. The remuneration policy is reviewed periodically or as required by regulations and is available to view upon request.

Sustainability-related disclosures

The Iguana Investments Long/Short Equity Fund (“Fund”) pursues an investment strategy that is designed in part to promote certain Environmental and Social characteristics in the manner contemplated by Article 8 of the SFDR. It does not however have, as its objective, sustainable investment as such term is understood in accordance with SFDR. The Environmental and Social characteristics the Fund seeks to promote are met by the integration of Environmental, Social and Governance ("ESG") factors into: (a) the investment analysis and (b) the investment decision making process for the Fund. In more detail:

Investment analysis. The Fund seeks to analyse and consider each potential company investment on its own merits and ESG issues are considered as part of fundamental analysis when evaluating an investment by reference to the UN Principles of Responsible Investment (PRI). The PRI approach in brief is to consider the impact of ESG factors relevant to an individual business or industry at all key assumption points when conducting detailed financial modelling and valuation on a potential investment. For example, a business that would generally be considered to have both a limited life and a heavy environmental impact, such as fossil fuel production, would see these negative environmental impacts reflected in the financial model and valuation by incorporating some or all of the following points:

1) a very low or significantly negative value assigned to the terminal growth component of the Discounted Cashflow valuation;2) a significantly higher than normal discount rate to reflect the poor quality and significant wider social and economic costs of corporate cashflows;3) and a lower future profit margin reflecting an expected future requirement for high regulatory emissions and remediation/clean-up costs likely to be required by the business.

In this example, these adjustments would cumulatively have a very material impact on the financial analysis, ensuring that the ESG drawbacks of the business model are adequately considered in parallel with the financial metrics and ensuring that ESG considerations are reflected in the investment analysis. ESG factors are incorporated into the modelling process using publicly available information and data feeds and are monitored on an ongoing basis.The security selection decision-making process. The second part of our ESG approach is to integrate ESG considerations at the conclusion of the investment analysis phase, when we make a portfolio investment decision or otherwise regarding an individual security. At this point, as discussed in our Investment Strategy (available on request), we operate an internal decision-making process to discuss and decide whether to invest in a security. The rationale behind the investment decision centres around a number of key ‘questions’ that we ask and answer that collectively should be answered in the affirmative if the inclusion of the security in the portfolio is to be justified. These questions cover several issues such as valuation, competitive position, strategy, management, and consideration of whether corporate actions are improving or reducing its current sustainability position. At present we focus primarily on considering three key factors which have been chosen to align with our corporate ethos of giving to wildlife research, our desire to help ensure strong and representative corporate governance in investee companies and the important issue of improving corporate behaviour. These factors are: 1) the overall level of corporate CO2 additions (especially Scope 3 emissions), 2) individual corporate governance considerations such as the composition of that company’s Board and 3) a summary measure of individual corporate sustainability. As further data becomes available and disclosure levels improve across the investee companies, we will continue to evolve the key factors that we consider at this point in the security investment decision.

The Investment Manager commits to be an active owner and to incorporate ESG issues into its ownership policies and practices and will seek appropriate disclosure on ESG issues by the entities in which it invests.

ANNEX IV

Template periodic disclosure for the financial products referred to in Article 8, paragraphs 1, 2 and 2a, of Regulation (EU) 2019/2088 and Article 6, first paragraph, of Regulation (EU) 2020/852

Product name: IGUANA INVESTMENTS, LONG/SHORT EQUITY FUND, (a sub-fund of the Iguana Investments ICAV)

Legal entity identifier: 213800B17U4ONHMYCA19

Environmental and/or social characteristics

To what extent were the environmental and/or social characteristics promoted by this financial product met?

The environmental and social characteristics promoted by the Fund during the reporting period 1 October 2023 to 30 September 2024 (the "Reporting Period") consisted of:

• reducing the aggregate level of greenhouse gas emissions of portfolio companies relative to constituent companies of the MSCI World Index (“Index”

• reducing the aggregate environmental footprint of portfolio companies relative to constituent companies of the Index as measured by carbon intenstity

• routine engagement with portfolio companies that may promote transparency, change and awareness with respect to environmental, social, and governance (“ESG”) considerations;

• the exclusion of issuers that were not aligned with certain environmental and social characteristics;

• Encouraging companies to have credible Net Zero Carbon strategies;

• Investing in companies which have women on their boards;

• Investing in companies with independent directors on their boards (independence);

• Ensuring companies have and implement anti-bribery policy

The Fund met these environmental and social characteristics, as measured by reference to the sustainability indicators set out below.

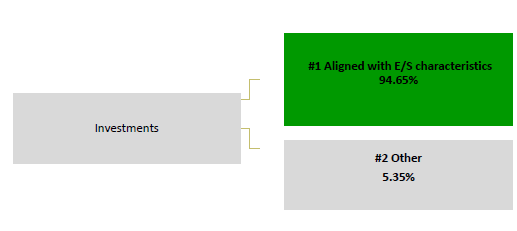

How did the sustainability indicators perform?

Over the reporting period, the average sustainability indicator scores were as follows:

Investments aligned with the Fund's environmental and/or social characteristics. As at the date of this disclosure were at 95.20%

…and compared to previous periods?

The percentage of investments aligned with the Fund's environmental and/or social characteristics have increased by 2.7% from 92.5% as at 30 September 2023

What were the objectives of the sustainable investments that the financial product partially made and how did the sustainable investment contribute to such objectives?

The Fund does not commit to making sustainable investments.

How did the sustainable investments that the financial product partially made not cause significant harm to any environmental or social sustainable investment objective

The Fund does not commit to making sustainable investments.

How were the indicators for adverse impacts on sustainability factors taken into account?

The Fund does not commit to making sustainable investments.

Were sustainable investments aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights? Details:

The Fund does not commit to making sustainable investments.

How did this financial product consider principal adverse impacts on sustainability factors?

This financial product did not consider principal adverse impacts on sustainability factors

What were the top investments if this financial product?

What was the proportion of sustainability-related investments?

As at the date of this disclosure the Fund had an allocation of 95.20% to such assets. The Fund does not commit to making sustainable investments

What was the asset allocation?

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments

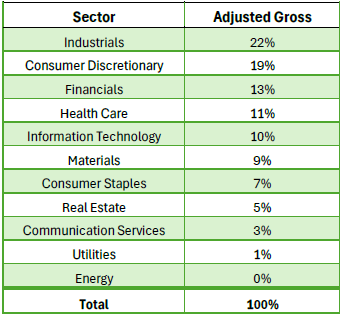

In which economic sectors were the investments made?

To what extent were sustainable investments with an environmental objective aligned with the EU Taxonomy?

The Fund does not commit to making sustainable investments.

Did the financial product invest in fossil gas and / or nuclear energy related activities that comply with the EU Taxonomy[1] ?

[1] Fossil gas and/or nuclear related activities will only comply with the EU Taxonomy where they contribute to limiting climate change (“climate change mitigation”) and do not significantly harm any EU Taxonomy objective - see explanatory note in the left-hand margin. The full criteria for fossil gas and nuclear energy economic activities that comply with the EU Taxonomy are laid down in Commission Delegated Regulation (EU) 2022/1214.

What was the share of investments in transitional and enabling activities?

The proportion of investments in environmentally sustainable economic activities is currently 0% of NAV, which comprises of 0% of NAV in transitional and 0% of NAV in enabling activities.

How did the percentage of investments that were aligned with the EU Taxonomy compare with previous reference periods?

Not applicable, as the this is the first period.

What was the share of sustainable investments with an environmental objective not aligned with the EU Taxonomy?

As the Fund does not make any sustainable investments, the minimum share of sustainable investments with an environmental objective that are aligned with the EU Taxonomy is 0% of the NAV.

What was the share of socially sustainable investments?

The minimum share of socially sustainable investments is 0% of NAV.

What investments are included under “#2 Other”, what is their purpose and are there any minimum environmental or social safeguards?

4.8% of assets were classed under “#2 Other”.

Investments Investments in “#2 Other” include investments that may not promote an environmental or social goal but these investments must still, at a minimum, meet the Fund’s good governance criteria and exclusionary policies. Investments that might fall

under "#2 Other" include equity securities or collective investment schemes (not aligned with E/S characteristics), cash positions, cash equivalents and financial derivative instruments.

What actions have been taken to meet the environmental and/or social characteristics during the reference period?

The Investment Manager executed the following ESG integration methods during the reference period to measure and promote the ESG characteristics described in previous section.

1. The Investment Manager maintained and updated proprietary quantitative model for the following reasons:

• To assess performance on sustainability for companies in the Investment Manager’s portfolios and investable universe;• To identify potential ESG issues of companies for futher qualitative ESG research and engagement

2. The Investment Manager conducted engagement calls with portfolio holding companies on material ESG issues to obtain additional research insights, encourage positive change for the ESG characteristics promoted, and to discuss any material

controversies. Through regular meetings and discussions with companies, the Investment Manager actively seeks increased transparency by encouraging more frequent and robust disclosure and the establishment of tangible ESG goals.

• In 2024, the Investment Manager engaged with 36 investee companies.

3. The Investment Manager took an active and responsible approach to proxy voting by using customized ESG proxy voting guidelines for casting votes, when required.

• In 2024, the Investment Manager completed proxy reviews and voted on 667 resolutions for 36 companies. In addition, the company discussed proxy voting matters during engagement calls referenced above.

4. Excluded Investments

The Fund applied the Revenue Exclusions and the Human Rights Exclusions throughout the Reporting Period meaning that the Fund:

invested no more than 10% of its total assets, excluding cash, in issuers that:

(i) derived more than 20% of their annual revenues from any of the following business activities: coal mining, coal power generation, oiland gas exploration, conventional and unconventional oil and gas production or the production or sale of tobacco; or(ii) derived any amount of revenue from the production or sale of controversial weapons; and did not hold investments in any issuers that were in breach of the principles of the United Nations Global Compact, including those in relation to the use of forced or child labour and within this their ESG footprint.

How did this financial product perform compared to the reference benchmark?

While the MSCI World Index (GBP) has been assigned to the Fund in order to monitor its performance there is no established reference benchmark to meet the environmental or social characteristics promoted by the Fund.

How does the reference benchmark differ from a broad market index?

Not applicable

How did this financial product perform with regard to the sustainability indicators to determine the alignment of the reference benchmark with the environmental or social characteristics promoted?

Not applicable

How did this financial product perform compared with the reference benchmark?

Not applicable

How did this financial product perform compared with the broad market index?

Not applicable